Intro

If you are new to the NFT space, it is easy to fall into the trap of following the hype as opposed to researching a project. Seeing NFTs sell for thousands of dollars is an incentive to unknowingly ape in and believe that what you have purchased will succeed, but this is simply not the case. Having a clear understanding of who the team is, the community, the vision, and the project are each extremely important to consider and research thoroughly. Don’t just follow the crowd, make your own informed choices and do your own research.

In this article, I will discuss some of the most important elements to consider before making decisions on projects in the NFT space.

The pitfalls of apeing in

Some see the NFT space as a gateway to making quick profits. While this can be true, this mindset is also counter-productive. Betting everything on one project and expecting bigger returns in weeks may see you get incredibly lucky or as degens say, severely rekt! Many will attest that a long-term outlook is key, and one of the most important factors.

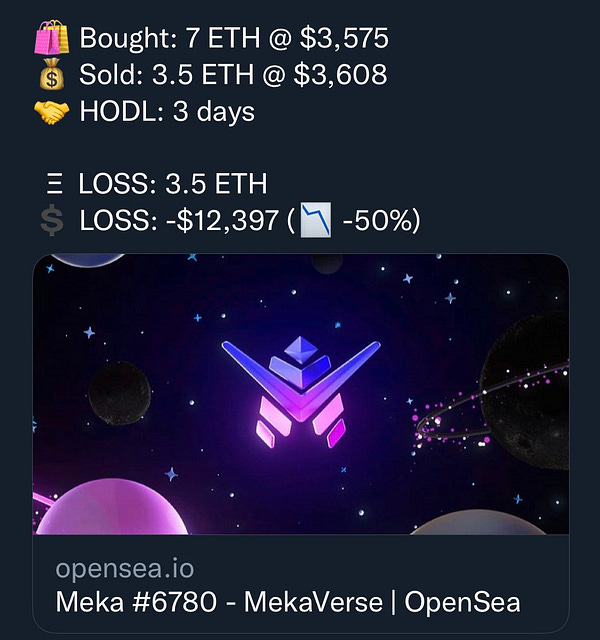

Take for instance the Mekaverse collection. Last month they were the most highly anticipated NFT drop in some time with many newcomers to the space seeing this as their opportunity for a breakthrough pfp project. Prior to the reveal of the artwork, the floor price of the placeholders skyrocketed to just under 10 ETH, however, just weeks later the floor dramatically plummeted to 1 ETH. The collection was faced with a number of criticisms, and consequently, the value dropped as quickly as it rose. Those that aped in during the peak will have lost tens of thousands IRL dollars while the team behind the project has made millions and will continue to earn royalties on every secondary transaction.

This example is an important reminder to be attentive to the projects around you. For many, it has taught them to avoid making impulsive decisions and to consider what in fact makes a good project. Interestingly, it has also catalyzed a shift in the market, pfp projects are becoming increasingly more difficult to sell out, largely because the market is so over-saturated. Where before many sold out instantly, now only the most unique and interesting ideas will pull through.

Judging a collection

It is very easy to jump on the hype train and fall victim to fomo in the NFT space. As discussed above, it can lead to irrational decisions and your hard-earned ETH can disappear as quickly as you gathered it. Of course, the space is volatile and any investment is a risk, but there are ways in which you can best judge the intentions of a collection before apeing in.

Who is the team?

It is important to find out who the team is. More often than not, if it is a completely anonymous team that has not shared who they are to the community, their intentions may not be to stay for the long term, irrespective of how interesting the project looks. Although some projects with anonymous teams have succeeded before, doxed teams are more likely to receive the support of the community. Especially with the rug pulls and scams that have become increasingly more common in the NFT space. There are 3 scales of identity which include:

Anonymous- no twitter, no background.

Semi doxed- Twitter trustworthy but not IRL displayed.

Doxed- Twitter and IRL selves displayed.

You can even create a checklist and utilize this when trying to find out who the team is.

How long have they been in the Twitter space?

Do they meaningfully interact with the community?

Do they support other projects in the space?

Who have they worked with before and what is their experience in what they are launching?

Are they supported by mutual creators in the NFT space?

What are their other works? Do they have links to prior projects and experiences?

Knowing exactly who the team is can give you that conviction in the project and give you the reassurance that this is a project being built for the long term.

Who is the community?

Let’s say you jump into the project’s discord, and instantly you are met by ‘wen’, ‘pump’, and ‘let’s get the floor to X!’ Instantly red flags are raised as these are evident signs of an artificial community. It probably means that many investing in the project are hoping to pump their bags and flip, which of course is never an ideal community to be a part of if you are looking through the scope of an investment perspective.

Never trust the numbers, a project can have thousands of members and equally, half of them could be bots. If they are utilizing a whitelist, members can make multiple accounts in hopes of grabbing more than one space. Subsequently, you have to look at the content of the interactions.

Are the members kind?

Are they excited for the future of the project?

Do they ask questions and want to learn more?

Do the members uplift one another and share their support?

Do the team and the community consistently interact with one another?

Do they welcome new members?

These are just a handful of factors that are important to consider when observing the community. They are signs of organic growth and will more often than not lead to something meaningful down the line. Even if it is a slow burner, this is still a good sign, organic growth trumps fast pumps and many in the space will also attest to this. Real success is built over time, not in a matter of days.

Genuine roadmap or copypasta roadmap?

Roadmaps have become less of a deciding factor when investing in projects. Since April, roadmaps were an important component and helped to steer the project and community in the right direction. Contrastingly, today roadmaps are less authentic with many collections copying the roadmaps of predecessors simply for the sake of doing so. Many of the features can be interesting, for instance giving to charity, airdrops, competitions, and in a project with good intentions they are valuable. But when a project is simply mirroring other projects for the sake of competing, this roadmap serves less of a meaningful purpose.

Some of the most successful projects have also offered no roadmap, take for example CrypToadz by Supergremplin. He created the collection, minted 10k and the community created their own value. Therefore although roadmaps were the benchmark for a certain time, this is not always the prerequisite for a successful collection.

Of course, this is not to say that roadmaps serve no purpose in the current climate, they certainly do. They help to set the vision and future of a project which is essential when making an investment. However, it is the authenticity that matters, this is the keyword.

Reactions

How do the team and project react to the climate of the market? The likelihood that floors will fluctuate is very high in the NFT space, in fact, it is inevitable. The key observation however is the reaction to this. The most successful projects discuss the floor, it is a daily occurrence, what matters is the depth of these discussions. Are they entirely fixated on the floor, do they spread FUD when prices plummet, do they encourage pumps? Or do they embrace the market, they continue to build and reassure the collectors that this is a long-term game. These are the signs that you must pick up on! The successful projects will always continue to build during the bear markets, this demonstrates that they are creating a project for the long term.

Final thoughts

With time in the NFT space, you will eventually create your own personal checklist to help you go forward!

This article does not constitute formal financial advice and is simply my own observations in the NFT space.